How to Hire a Virtual Assistant for Accountants: Hiring Guide

If you want clarity on how to hire a virtual assistant for accountants, focus on task delegation, accounting-specific skills, secure workflows, and hiring sources that align with your firm’s operations.

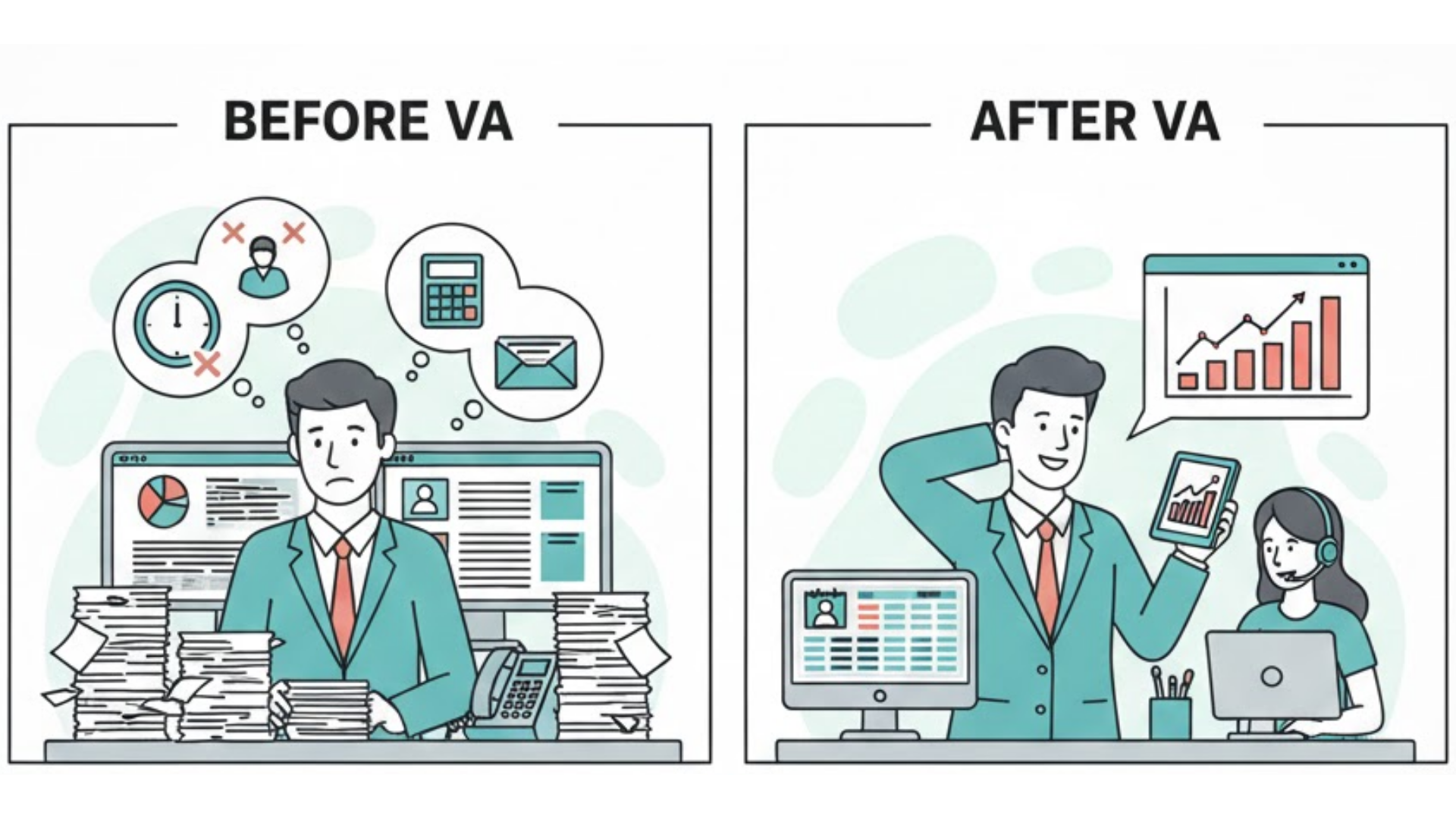

You sit down to review financial statements, but before you can even open the file, your inbox fills with client follow-ups, missing documents, calendar requests, and bookkeeping questions. By the time those are handled, most of the day is gone, and the real accounting work moves into the evening. This cycle repeats every week and leaves you feeling stretched without actually moving the firm forward.

Learning how to hire a virtual assistant for accountants helps you break that cycle without expanding your in-house team. This guide walks you through the process in a way that feels practical, realistic, and aligned with how accounting firms actually work.

If you built your firm around traditional staffing, virtual support may feel unfamiliar. You may question accuracy, responsiveness, or security. You may also assume that virtual help applies only to simple admin work. When hired correctly, a virtual assistant can support real accounting workflows and remove daily pressure. Understanding the process turns hiring into a business decision that supports growth instead of adding stress.

Related Article: What Is a Bookkeeping Virtual Assistant and What Can They Do?

DELEGATION ISN’T JUST A TASK—IT’S A STRATEGY.

Learn how to delegate with clarity and purpose so your team thrives and your business grows.

Why Accountants Should Consider Hiring a Virtual Assistant

Daily Tasks That Quietly Drain Your Time

Your expertise lies in financial analysis, compliance, and advising clients. Yet a large portion of your day disappears into emails, scheduling, document organization, and follow-ups. These tasks are necessary, but they prevent you from focusing on revenue-generating work. A virtual assistant for accountants helps you reclaim those hours by taking ownership of recurring responsibilities. When routine work is handled consistently, your day becomes more structured and manageable.

During busy seasons, the pressure intensifies. Month-end closings and tax deadlines stretch your schedule even further. Virtual support allows you to add help without committing to permanent staffing. This flexibility protects your energy and your service quality. Over time, your firm operates with more balance.

Financial Control Without Staffing Overhead

Hiring in-house staff involves more than a salary. Benefits, office space, equipment, and downtime all affect cash flow. Virtual assistants typically work on hourly or fixed plans, which gives you more control over spending. This structure allows you to budget accurately and avoid unnecessary expenses.

An accounting virtual assistant supports your firm without adding payroll complexity. You pay for productive work rather than idle hours. This approach works well for small and growing firms. Financial planning becomes easier when staffing costs remain predictable.

Related Article: Best Practices for Managing Virtual Teams Successfully

Stronger Client Relationships

When your schedule is overloaded, client communication often feels rushed. Delegating support tasks allows you to respond faster and prepare more thoroughly. Clients notice that improvement. Better communication leads to stronger trust and retention.

With fewer distractions, you also have time to expand advisory services. Your firm becomes more proactive rather than reactive. Virtual support helps create that shift naturally.

What Tasks Can a Virtual Assistant Handle for Accountants?

Inbox Management, Scheduling, and Client Requests

Client communication generates a steady stream of messages related to deadlines, document requests, and scheduling changes. A virtual assistant can monitor your inbox daily, tag urgent client emails, and respond to routine questions using templates you approve. They can schedule client calls based on your availability, send calendar invites, and confirm meetings in advance. When a client reschedules or cancels, your assistant updates the calendar and notifies you right away. A virtual assistant for accountants also keeps track of unanswered messages, so no request gets overlooked.

With this support in place, interruptions throughout your day decrease significantly. You spend less time switching between email and accounting work. Client communication feels structured rather than reactive. Your attention stays on tasks that require your professional judgment.

Transaction Entry and Expense Categorization

Entering transactions manually can take hours each week, especially across multiple clients. A trained bookkeeping VA can input bank and credit card transactions into QuickBooks or Xero based on your chart of accounts. They categorize expenses, assign vendors, and add memos when clarification is needed. If a transaction looks incorrect or unclear, they flag it for your review instead of guessing. This keeps your records clean and review-ready.

They can also match receipts to transactions and organize supporting documents in your cloud storage system. This makes audits and reviews easier later. You spend less time cleaning up data. Month-end work becomes more predictable.

Bank and Credit Card Reconciliations

Reconciling accounts often gets delayed because it requires uninterrupted time. A virtual assistant can perform monthly bank and credit card reconciliations and identify discrepancies early. They compare statements to accounting records and highlight unmatched transactions. This allows you to review and approve corrections quickly.

A remote bookkeeper supporting reconciliations helps prevent compounding errors. Issues are addressed monthly instead of piling up. Your financial reports become more reliable. You reduce last-minute stress during closings.

Financial Report Preparation for Review

Before you analyze financials, someone has to prepare them. A virtual assistant can generate draft profit and loss statements, balance sheets, and cash flow reports from your accounting software. They export reports, format them based on your firm’s standards, and ensure date ranges are correct. They can also compile reports for multiple clients into a single review folder.

An accounting virtual assistant can track which reports are completed and which still need data. This keeps your review process organized. You focus on insights instead of preparation. Client delivery becomes more consistent.

Tax Season Document Tracking and Follow-Ups

During tax season, managing documents often takes more time than preparing returns. A virtual assistant can maintain a checklist of required tax documents for each client. They track what has been received and what is still missing. When documents are outstanding, they send reminders according to your schedule.

They can also organize tax documents into labeled folders so nothing is misplaced. This keeps returns moving forward. You avoid delays caused by incomplete information. Client coordination feels controlled instead of chaotic.

Client Onboarding and Ongoing Account Maintenance

When you onboard a new client, there are multiple steps involved before work begins. A virtual assistant can send engagement letters, collect intake forms, and request system access based on your instructions. They ensure all required information is received before you start work. This prevents back-and-forth later.

For ongoing clients, your assistant can update contact details, service notes, and recurring task schedules. They manage monthly bookkeeping reminders and service renewals. A virtual assistant for accountants keeps client records current so you always have accurate information. This supports long-term client management without extra effort from you.

Key Skills to Look for in a Virtual Assistant for Accounting

Practical Accounting Knowledge You Can Use Immediately

You need a virtual assistant who understands how accounting work actually flows, not someone learning terminology for the first time. This means they should already know how transactions move from bank feeds into reports, how reconciliations work, and why clean records matter. When you assign transaction entry or reconciliation tasks, they should understand why certain expenses belong in specific accounts. An assistant with real accounting exposure requires less correction and less explanation. This level of knowledge allows you to delegate confidently instead of checking every small step.

An accounting virtual assistant with hands-on experience understands monthly cycles, quarter-end pressure, and tax season timelines. They know that delays create downstream problems. This awareness helps them work with urgency and accuracy. You spend less time teaching fundamentals and more time reviewing outcomes.

Software Experience That Matches Your Workflow

Accounting work depends heavily on software, so your assistant must already be comfortable using the tools you rely on. Experience with QuickBooks or Xero should go beyond logging in and navigating menus. They should know how to import transactions, categorize expenses, reconcile accounts, and generate reports without step-by-step guidance. Familiarity with cloud storage systems and client portals also matters because document handling is part of daily work.

Accuracy in Repetitive and Detail-Heavy Tasks

Much of the work you delegate involves repetition, which makes attention to detail essential. A reliable bookkeeping VA develops habits that prevent small errors from accumulating. They should consistently enter transactions correctly, follow naming conventions, and apply your chart of accounts without shortcuts. When reconciling accounts, they must identify mismatches rather than force balances to match. Accuracy at this level protects your reports and your credibility.

Clear Written Communication and Follow-Through

Since most communication happens remotely, clarity matters more than ever. Your assistant should write concise, professional emails to clients using your approved language. They should ask clarifying questions when instructions are unclear instead of making assumptions. Updates should be timely and specific, so you always know the task status.

Strong communication also shows in follow-through. When a task is assigned, it gets completed or flagged if an issue arises. You are not left guessing. An effective accounting virtual assistant helps you stay informed without constant check-ins.

Understanding of Confidentiality and Data Handling

You work with sensitive financial and personal information every day. Your virtual assistant must understand confidentiality as part of their role, not as an afterthought. This includes using secure file-sharing methods, respecting access limits, and following your internal security procedures. Careless handling of data creates risk for your firm and your clients.

How to Find a Qualified Virtual Assistant for Your Accounting Firm

Working With Specialized Virtual Assistant Agencies

Agencies that specialize in accounting support manage recruitment and screening. They match you with assistants trained for accounting workflows. This saves time and reduces hiring risk. Support and replacements are often included.

Hiring through an agency like Smart VAs gives you access to professionals quickly. A bookkeeping VA from an agency follows structured processes. This option suits firms that want reliability. Administrative effort stays minimal.

Interviews and Trial Periods

Interviews help you assess communication and practical knowledge. Task-based questions reveal real experience. Trial assignments show how instructions are followed. This provides clarity before commitment.

Trial periods reduce uncertainty. You evaluate performance in real conditions. Adjustments happen early. Confidence grows through hands-on experience.

Onboarding and Workflow Integration

Clear onboarding sets expectations early. Documenting processes and tools helps your assistant integrate smoothly. Consistency improves when instructions are clear. Feedback supports progress.

Training does not need to be complex. Simple walkthroughs work well. Over time, your assistant becomes more independent. Strong onboarding leads to long-term efficiency.

Ready to Simplify Your Accounting Tasks?

Smart Virtual Assistant

👍🤵

Smart Virtual Assistant 👍🤵

Understanding how to hire a virtual assistant for accountants helps you regain control of your time without adding internal overhead. Delegating the right tasks creates consistency in your workflow and frees you to focus on client work that truly matters. Virtual support adjusts to your busy seasons and growth plans, allowing you to scale without disrupting operations.

With Smart VAs, you gain access to experienced virtual professionals who understand accounting processes, deadlines, and confidentiality. Beyond administrative and accounting support, Smart VAs also provides a team of virtual specialists, including web managers, social media managers, podcast managers, video editors, copywriters, graphic artists, ads specialists, and project managers. This means you can offload accounting work and the other responsibilities competing for your attention, so your entire to-do list feels lighter. Book a call now!

FROM OVERWHELMED TO CEO IN 7 DAYS

Your shortcut to building a team of specialists who keep your business moving without you doing it all.

Frequently Asked Questions

-

Hiring a virtual assistant for accounting typically costs less than hiring in-house staff. Rates depend on experience and task scope, with many firms choosing fixed monthly plans for predictable costs. A remote bookkeeper or accounting-focused assistant eliminates expenses like benefits, office space, and equipment.

-

Yes. A virtual assistant can support tax preparation by collecting documents, organizing client files, and preparing data for review. Licensed accountants or CPAs still complete and file returns. An experienced accounting virtual assistant helps speed up the process without handling regulated work.

-

You verify trust through screening, prior experience, trial periods, and clear confidentiality rules. Reputable agencies apply security standards and monitor performance. Consistent accuracy and follow-through confirm reliability over time.

-

Basic administrative and bookkeeping tasks can be onboarded within a few days. More complex accounting support may take one to three weeks, depending on documentation and workflows. Clear processes significantly shorten onboarding time.

-

Yes. Virtual assistants are available for part-time, full-time, or project-based work. A virtual assistant for accountants adjusts to your workload and scales as your firm grows.

Ready to Work Smarter, Not Harder?

Smart VAs provides a team of highly skilled specialists from around the world, ensuring seamless support no matter the time zone. We take pride in delivering efficient, fast, and high-quality service so you can focus on growing your business. With one subscription plan, you gain access to a complete team of digital marketing experts that’s customized to your unique needs, eliminating the need to train and look for one yourself!